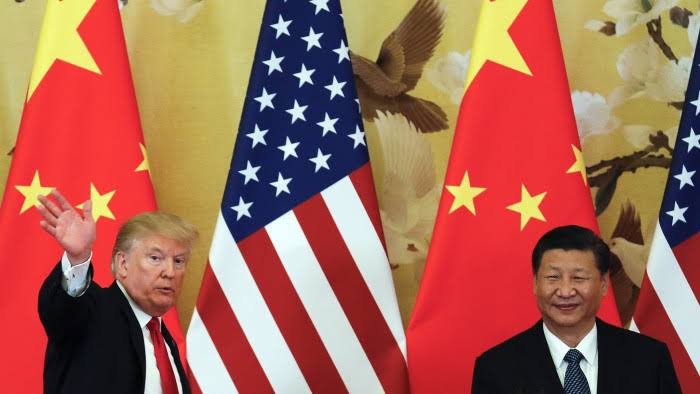

2025 US-China Trade Deal: Major Tariff Reductions and Market Impact

Latest Update (May 12, 2025): The US and China agreed in Geneva to temporarily slash reciprocal tariffs from over 100% to 10% for 90 days, with US tariffs on Chinese goods effectively dropping to 30% (including existing fentanyl-related duties). Global markets surged on the news.

Key Details of the 2025 Geneva Agreement

Tariff Reductions

- US tariffs on Chinese goods drop from 145% to 30% (10% base rate + 20% fentanyl-related duties) [citation:1][citation:6]

- Chinese tariffs on US goods fall from 125% to 10% [citation:5][citation:8]

- Changes take effect by May 14, 2025, for 90 days [citation:2][citation:10]

- Previous tariffs (e.g., 25% on industrial goods, 100% on EVs) remain unchanged [citation:1][citation:6]

Non-Tariff Measures

- China agreed to remove countermeasures imposed since April 2025, including rare earth export restrictions [citation:6]

- New economic dialogue forum established between US Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng [citation:1][citation:9]

“The consensus from both delegations is neither side wants a decoupling… What had occurred with these very high tariffs was the equivalent of an embargo.”

— US Treasury Secretary Scott Bessent [citation:1][citation:5]

Market Reactions to the Deal

Immediate Financial Impacts

- Dow Jones surged

The Latest on the US-China Trade Deal and Tariff Updates

Understanding the US-China Trade Deal

What is the US-China Trade Deal?

The US-China trade deal, often referred to as the Phase One agreement, was signed in January 2020 under the Trump administration. It aimed to reduce economic tensions by addressing trade imbalances, intellectual property theft, and forced technology transfers.

Key components included:

- China’s pledge to purchase $200 billion worth of US goods

- Reduced tariffs on certain Chinese imports

- Commitments to structural reforms in China’s trade practices

Has the Deal Been Successful?

While initial progress was made, the deal faced challenges due to:

- The COVID-19 pandemic disrupting supply chains

- China falling short of its purchase commitments

- Continued tariffs on billions of dollars worth of goods

Recent reports suggest the Biden administration is reviewing the deal’s effectiveness, with possible renegotiations ahead.

Latest China Tariff News

Current Tariffs on Chinese Imports

Since 2018, the US has imposed tariffs on China covering over $350 billion in goods. These tariffs range from 7.5% to 25%, affecting industries like electronics, machinery, and consumer goods.

What Were Tariffs on China Before Trump?

Before the Trump administration, the average tariff on China was around 3%. The significant increase was part of a strategy to pressure China into fairer trade practices.

Will Biden Remove China Tariffs?

The Biden administration has kept most Trump-era China tariffs in place while considering targeted reductions to ease inflation. Key updates include:

- Potential tariff relief on consumer goods to lower prices

- Continued tariffs on strategic industries like semiconductors and clean energy

- Ongoing reviews by the US Trade Representative (USTR)

Impact of Chinese Tariffs on the US Economy

- Higher Consumer Prices: Tariffs have contributed to inflation, raising costs for businesses and consumers

- Supply Chain Disruptions: Many companies have shifted sourcing to avoid tariffs, leading to longer lead times

- Stock Market Reactions: Dow Jones Live updates often reflect trade tensions, with volatility around tariff announcements

Fox Business and Other Sources on Trade Developments

Key Figures in the Trade Debate

- Jamieson Greer: Former USTR Chief of Staff who played a role in negotiating the Phase One deal

- Scott Bessent: A hedge fund manager with insights on China’s economic strategies

How Media Covers Trade News

Outlets like Fox Business provide real-time updates on China-US trade deal developments, tariff news, and market reactions. Investors follow TSLA premarket movements, as Tesla’s supply chain is heavily tied to China.

Summer Travel and Economic Warnings

Summer Air Travel Warning

With rising fuel costs and ongoing trade tensions, airlines face operational challenges. The summer travel warning highlights potential delays and higher ticket prices due to:

- Increased jet fuel costs linked to global trade policies

- Reduced flight capacities in some international routes

How Trade Policies Affect Travel

- China-US flight restrictions impact business travel and tourism

- Switzerland and other neutral trade hubs see increased business relocations amid US-China tensions

Future of US-China Trade Relations

Possible Scenarios

- Renegotiation of the Trade Deal: The US may push for stricter enforcement or new terms

- Partial Tariff Reductions: Some tariffs could be lifted to combat inflation

- Continued Trade War: Escalation remains possible if negotiations stall

What Businesses Should Watch

- Economy news from the Federal Reserve and USTR

- China news regarding manufacturing and export policies

- Dow Jones Live trends reflecting investor confidence

Conclusion

The US-China trade deal and tariffs remain critical to global markets. While the Phase One agreement provided a temporary framework, ongoing disputes and economic pressures keep the situation volatile. Businesses and investors must stay updated on China tariff news, Fox Business reports, and economy news to navigate the evolving landscape.

For real-time updates, follow Dow Jones Live, TSLA premarket movements, and official statements from the USTR. The future of trade deals with China will shape not only US-China relations but also the broader global economy.